Book All about invoices

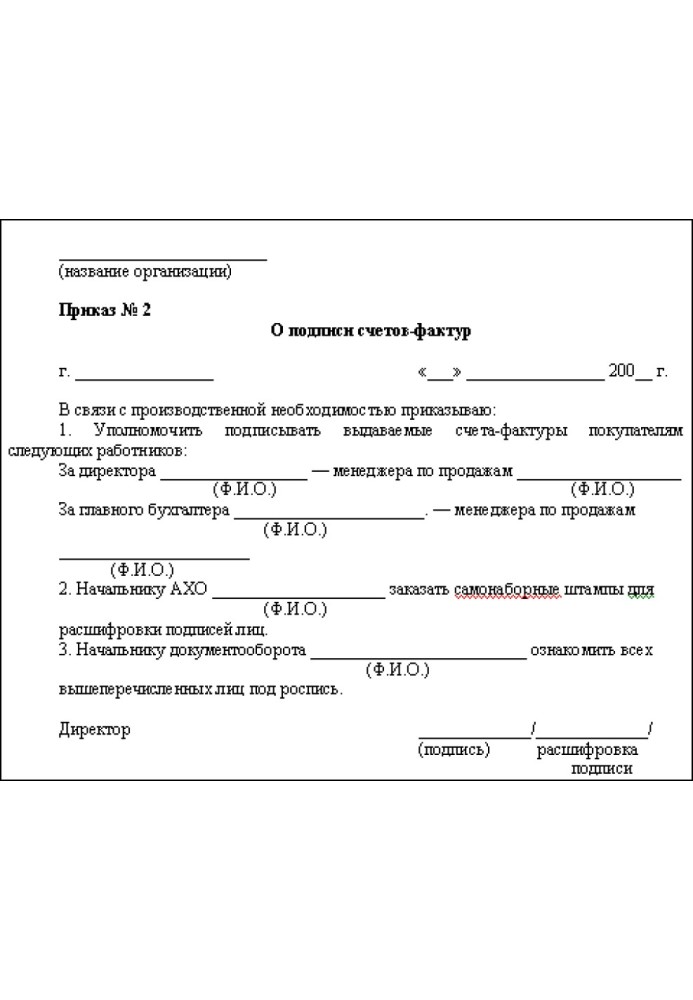

The new procedure for filling out and using invoices is discussed in detail, including when returning goods, selling at a discount, providing utilities, and performing work. The rules of accounting and tax accounting are described in detail, which is especially important when claiming VAT for deduction. Practical recommendations are given for difficult situations, such as when invoices are issued late or goods arrive without an invoice. It is shown how to make corrections to an invoice so that there are no disagreements with the tax authorities. Numerous examples from judicial practice are given. For accountants, economists, managers and heads of organizations, as well as for auditors and tax officials.

- Name of the Author

- Анна Клокова Валентиновна

- Language

- Russian

More books on this topic

Book The Girl Who Raced Fairyland All...

131 UAH

118 UAH

Book How to let big money into your life

56 UAH

51 UAH

Book Reasonable asset allocation. How...

121 UAH

109 UAH

Book Algorithm for Success. Ten...

86 UAH

78 UAH

Book Unfair advantage. The Power of...

121 UAH

109 UAH

Book The future of banking. Global...

119 UAH

108 UAH

Book The science of money. How to...

86 UAH

78 UAH

Book Volume 5. People are so bored in...

137 UAH

124 UAH

Book Consumer protection: frequently...

76 UAH

69 UAH

Book Investing is easy

76 UAH

69 UAH